Best Home Mortgage Lenders in Arizona Ideas

If you make an application for a cash loan, your application could acquire an authorization quickly based on your financial institution. Locating a payday advance is simple as well as quickly, available for those with dreadful credit rating that desire little amounts of money. It is an amazing cash advance if you are able to settle it in time.

If you've got an FHA lending you may certify to refinance your home loan under the FHA improve program. FHA lendings offer an abundance of advantages for numerous home buyers. They are fantastic for anybody that's looking to acquire a house. They are supplied by personal mortgage business that are authorized by the FHA. Personal car loans offer many advantages over various other sorts of loans. An unsecured loan for inadequate credit score, is a type of financial help progressed to customers to satisfy their fundamental or pushing financial demands.

You must re-finance your mortgage if it is going to shorten your finance term as well as lower your interest rate. FHA home loans are the easiest sort of loan to meet the needs for. FHA-insured home mortgages allow you to make use of homebuyer programs. Adjustable price home mortgages are regularly used by property buyers that mean to market their residence or refinance prior to the preliminary period of fixed prices ends.

1 loan provider might provide the suitable bargain yet pays a little commission. If you wish to get the best lending institutions in your area, you might utilize our rate comparison device or begin exploring our very best home loan loan provider web pages by state, which offer comprehensive information on loan providers for usual kinds of borrowers. Some even more portable lenders concentrate on car loans for people with dreadful credit rating. A prompt home loan loan provider reaches you a financial loan directly rather than experiencing a broker. If you're looking for the absolute best home loan lending institutions in Arizona, we've completed the research study.

Leading Options of Best Home Loan Lenders in Arizona

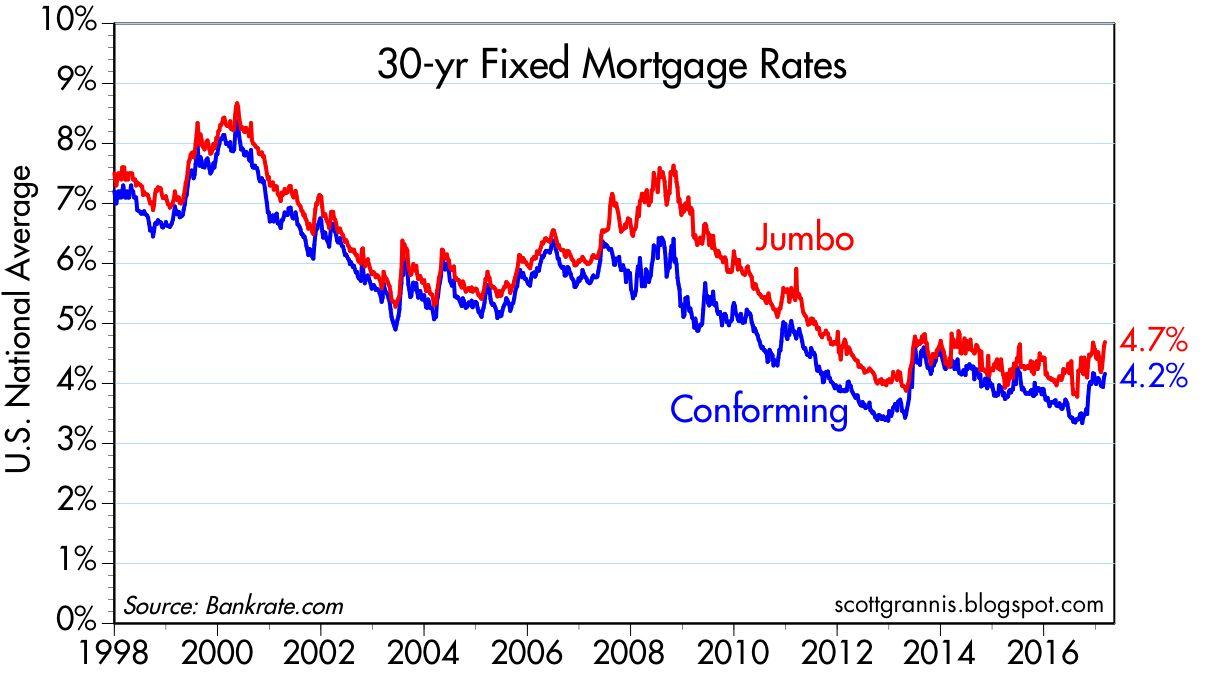

Rate of interest have a tendency to rise and fall quite a bit as time passes. You may be able to acquire a better interest rate if you have a number of fundings through precisely the exact same financial institution. The interest rate for a fixed-rate home loan stays the exact same for the size of the funding if you do not refinance for a reduced interest rate. Home loan rates of interest transform from year to year as well as are inclined to be higher as soon as the economy is doing well.

Best Home Mortgage Lenders in Arizona - Introduction

In some instances the broker might charge increased source fees. Mortgage brokers are beneficial in a great deal of methods. They can still mortgage rates in arizona be a good idea. Initially though see if you're able to observe just how much the home loan broker will certainly charge. A superb home loan broker knows a lot more about financings than a superb banker will certainly ever have the ability to get their hands on because they have a bigger market. While in search of amortgage car loans expert in Arizona, you must make certain that you are employing a licensed and also educated home mortgage broker.

Sort Of Best Home Loan Lenders in Arizona

Refinancing specifically has actually never ever been easier, and it is a good way to reduce your month-to-month payment. To determine if it can save you money in the long term, separate your complete closing expenses by your monthly savings. Simply put in the time now to repay your charge cards, and also don't secure any brand-new financings as you're preparing to place in an application for a home loan. To discover the very best rate of interest on your home mortgage, you ought to have outstanding credit history.

If you have actually got an FHA car loan you could certify to re-finance your home loan under the FHA streamline program. You need to re-finance your home loan if it is going to reduce your car loan term and also reduced your rate of interest. A prompt mortgage lending institution extends to you a monetary loan directly as opposed to going via a broker. The price of rate of interest for a fixed-rate home mortgage stays the specific same for the length of the funding if you don't re-finance for a lower rate of interest. While on the lookout for amortgage lendings specialist in Arizona, you must be sure that you are utilizing a qualified and well-informed home loan broker.